The Dirty Secret Behind Personal Loan Interest Rates: A 2023 Study

By Andrew Latham, Content Director, SuperMoney

Summary

In recent times, the domain of personal loans has evolved into a complex landscape laden with varying interest rates that tend to confuse consumers. Many assume that all lenders provide similar rates to people based on income and credit scores, but that is not entirely true. Although most lenders do use income and credit scores to determine rates, there are big differences in the rates lenders will offer the same borrowers.

A recent study carried out by SuperMoney shows just how big the differences can be. The good news is that thanks to innovations in financial technology, consumers can easily compare multiple lenders and find the best deal for them.

One might assume that personal loans would mirror the characteristics of a commodity like corn or gold, where the price is largely standardized.

The underlying principle is simple: money is a universal entity, and there should be minimal discrepancy in what lenders charge for lending the same amount. A free market economy, in its ideal form, should naturally iron out any price disparities, especially for identical commodities like cash. The presumption is that a greater number of lenders in a market would lead to lesser price variance.

Contrary to this theoretical framework, the consumer lending market exhibits a very different reality. Anyone who has ventured into the realm of personal loans would attest to the importance of selecting the right lender, as the interest rates can significantly vary. Assuming that rates will not vary much among borrowers with the same credit score can be an expensive mistake.

SuperMoney, a fintech platform that allows borrowers to compare multiple loan offers and select the one that aligns with their financial objectives, aggregates dozens of lenders. This allowed them to compare the average divergence between the highest and lowest Annual Percentage Rate (APR) for identical loan terms. SuperMoney’s study looked into 160,000 loan offers to over 15,000 borrowers and found that just comparing multiple lenders can be more beneficial when it comes to finding the lowest rate than getting a 100-point increment in your credit score.

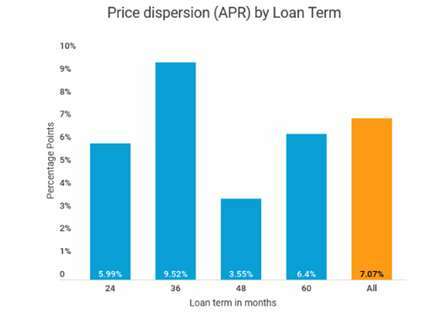

The average divergence between the highest and lowest APR stood at 7.1 percentage points. This variance stems from many factors, including lenders’ risk tolerance, cost of capital, underwriting models, and overarching business objectives.

Does this divergence matter in the big scheme of things? To add perspective, in 2020, the cumulative balance of personal loans in America amounted to $323.5 billion. A minor fluctuation in interest rates can translate into a monumental impact on consumers’ debt. For instance, assuming a 36-month term and a 13.5% APR on the mentioned balance, a mere reduction of 3.5 percentage points in the average APR to 10% could potentially save Americans over $19 billion in interest payments.

For instance, a borrower with a credit score of 720 seeking a $30,000 loan with a 36-month term received offers ranging from 5.99% to 15.87% APR. This variation, also known as price dispersion, could amount to savings of up to $5,050, which is 17% of the loan balance.

The narrative becomes compelling for borrowers with fair and good credit scores, where an 8 percentage point price dispersion was observed. Surprisingly, even those with excellent credit could substantially lower their APR by engaging in comparison shopping.

One common apprehension among borrowers is the impact on their credit score while applying to multiple lenders. The concern is valid; every hard inquiry can slightly lower your credit score. However, many lenders offer a prequalification process that involves a soft credit pull, which does not affect your credit score. Platforms like SuperMoney streamline the comparison process by showcasing prequalified offers from various online lenders based on a soft credit pull.

The bottom line is that comparing multiple lenders when shipping for a loan can save consumers hundreds, if not thousands, of dollars. The dirty secret behind personal loans is that rates don’t align neatly with your credit score and income. The good news is there are fintech tools that can help you find the best deal available.